We’ve been tracking the financial evolution of the digital health industry very closely over the last many quarters because of the frantic pace of activity taking place. The explosion in all manner of investments at all stages of company development and financial exits (M&A, IPOs, SPACs) taking place in the sector in the years 2020 and 2021 made the economic happenings in the industry almost as important as the digital health and medical technology discoveries and innovation.

Was the intense pace of investment in digital health over the last 2 years maintained in Q1 2022?

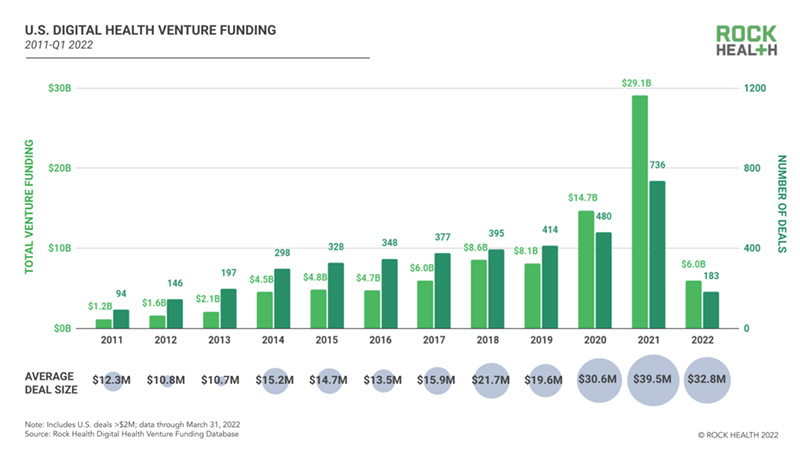

We reported that the combined investment in digital health that took place in 2020 and 2021 was higher than in the previous 10 years combined. We addressed the key elements driving this trend in our Six key trends impacting Digital Health in 2022 report and we wondered if taking into account the changing market environment – Correcting financial markets particularly in new IPOs, SPACs and tech stocks, winding down of the COVID pandemic, high inflation driving higher interest rates, well funded companies consolidating their operations, a surprise war in Ukraine, etc, – the torrid pace of investment that had been the primary narrative in medtech could be maintained.

Now, at the end of the first quarter we have the data available to provide some insight into these issues from the trusted team at Rock Health, a leading digital health advisory and capital investment firm, in their Q1 2022 digital health funding report.

Q1 2022 is seeing a continuation of the high rate of investment from recent years and is only down about 10% from 2021’s mega record pace

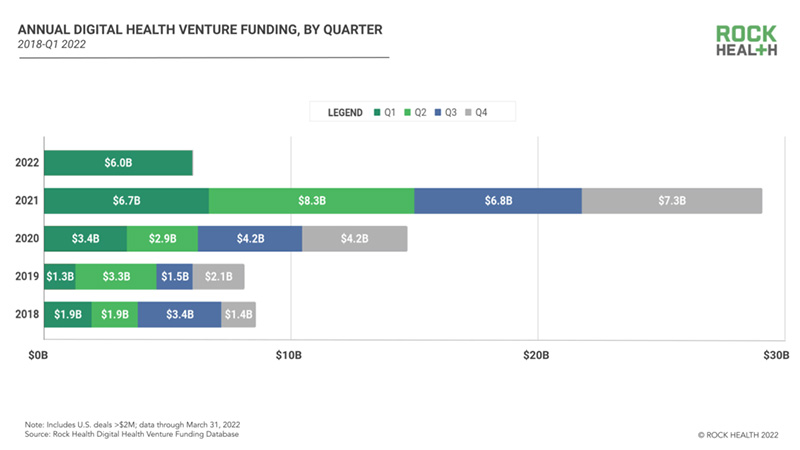

Q1 2022 U.S. digital health investment closed at $6.0B across 183 deals, with the average deal valued at $32.8M. This is only slightly lower than the record $6.7B invested in 2021, and considering the significant headwinds in the economy it indicates an extension to the intense pace of investment in digital health companies.

Active early stage and private funding levels notwithstanding we did experience a significant pullback in the value of digital health companies already trading in public markets via either IPO or SPAC, again this is as expected to some extent and addressed in our Six key trends impacting digital health in 2022 report where we identified the frothy financial markets and expected correction as a potential risk factor to the medtech industry and investment in general. More difficult exits tend to generate less investment.

Interestingly the digital health stocks getting hit hardest in the public markets are the new SPACs, down an average of 57% from Q3 2021 to now. This is almost double the 29% drop of traditional IPOs in the same period. This makes sense to some extent when taking into account that the average SPAC company is 3 years younger than the average IPO company. More recently we’ve seen SPAC deals cancelled, taken private and companies being sued. In short we’re seeing a stabilization and financial consolidation in what was the greatest pace of investments and exits in the history of the digital health industry.

Is it possible that some medtech companies that were unready to be publicly listed were only able to do so because of the boom cycle and the SPAC vehicle? The data seems to indicate this to be the case. It will take some time for the market to adjust to these dislocations. That said the fundamental opportunities in medical technology remain abundant and we expect the pace of investment and innovation to continue strongly regardless of short term consolidations and adjustments.

Montreal Digital Health Ecosystem Recent Happenings

Many notable events also took place across the Canadian digital health market and particularly in the Montreal digital health ecosystem in Q1 2022. Being one of Canada’s primary hubs for digital health, medical technology and AI many newsworthy fund raises, medtech service launches, joint ventures, M&A and other activities took place. Below are some of the highlights:

- Clinia closed $5 Million to scale B2B health search infrastructure

- TELUS Health continues Canadian Healthtech acquisition spree with Sprout

- Roche launching national AI, digital health initiative alongside AMII, MILA, Vector Institute

- TELUS Health launches virtual pharmacy service nationally

- Montreal’s Jewish General Hospital sets up ‘virtual care ward’ during fifth wave

- Innovation and artificial intelligence in healthcare: two musts for most Quebecers

- Oncology innovators Canexia Health, Imagia merge, raise $20 Million

This first quarter of 2022 represented what could have been a tough quarter for the industry coming off the mega-record performance of 2021 and the many challenges developing in the economy, and yet investment for the most part help up fairly well. Clearly this is only one quarter but this performance bodes well for the resilience of the industry and the remainder of the year. We will follow the story closely and report accordingly.

About BML Technology

BML Technology understands digital health. At the intersection of medical technology, clinical research and patient-centric healthcare BML drives the mainstream adoption of digital technology in healthcare. Offering a full range of services to the digital health ecosystem BML manages the complex stakeholder interactions necessary to get digital health solutions to market and gain adoption.

Stay Connected with BML Technology.

Connect with BML Technology on LinkedIn.